“傳統意義上,毛里求斯是以其白色海灘和高級度假酒店而聞名于世。然而,在過去十年中,該島卻被公認為監管完善的國際金融中心,吸引了大型銀行、跨國公司、基金經理和高凈值人士。經濟合作與發展組織(OECD) 發布的第 一份‘白名單’顯示,該管轄區致力于實施國際商定的稅收標準。毛里求斯金融服務業的發展始于1992年,從那時起,該島吸引了許多國際企業在全球投資。”毛里求斯駐華大使王純萬閣下是在2022年5月12日的“投資非洲:毛里求斯如何助力您進駐非洲”主題研討會上致辭發言的。

毛里求斯駐華大使王純萬閣下致辭原文如下:

各位同僚,嘉賓和朋友們

南非的朋友們,早上好!亞洲的朋友們,下午好!

請允許我向來自中國和其它地區能夠參與此次網絡研討會的同僚和嘉賓們表示熱烈的歡迎, 感謝瑞致達邀請我參加本次網絡研討會。

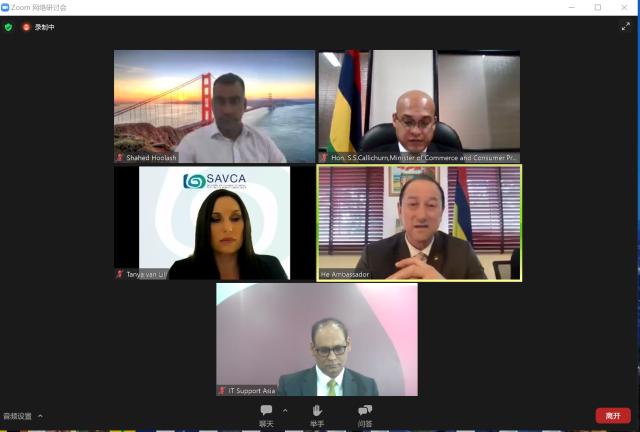

2022投資非洲-毛里求斯如何助力您進駐非洲網絡會議截圖

毛里求斯是許多國家的入境和出境投資中心,包括中國對非洲的投資。該島正日益被視為向非洲國家投資的平臺。毛里求斯的地理位置使該島在向非洲市場提供服務方面展現出了顯著優勢,官方統計數據顯示,進入非洲的外國直接投資中有很大一部分是通過毛里求斯的投資工具進行的。毛里求斯是幾個區域貿易區的成員,包括東部和南部非洲共同市場(東南非共同市場) 和南部非洲發展共同體(南共體),并簽署了廣泛的雙重稅收協定(DTA)和投資促進和保護協定(IPPA)。毛里求斯與包括中國在內的國家以及法國和英國等歐洲國家有著密切的歷史、政治、經濟和文化聯系。擁有一個基于英國普通法和法國拿破侖民法典的混合法律體系。毛里求斯作為國際金融中心的魅力之處已超出了對稅收規劃的考量。投資者選擇毛里求斯作為有利的控股公司管轄地是出于商業原因,包括高質量的服務、法律和監管框架,以及該管轄地的良好聲譽。毛里求斯還擁有良好的政治,經濟和社會穩定性。

環球云鏈·世界商人網主編王曉玲與毛里求斯駐華大使王純萬閣下在毛里求斯駐華大使館合影(資料)

我確信部長們將會談及以下一些重要的方面:

§ 作為全球投資平臺的跳板

§ 集合了擁有共同管轄權的投資者

§ 無線互聯的 DTA 雙重稅收協定網絡,覆蓋 10 個亞太國家和 15 個非洲國家 § 具有吸引力的財政政策與低稅收區域

§ 對投資者友好的司法區域

§ 無外匯管制

§ 高效的銀行業

§ 信息保密

§ 優秀的雙語專業人員

毛里求斯的全球商業部門為對非洲的投資項目提供了理想平臺。 毛里求斯提 供了各種投資工具,包括基金、公司結構、信托(固定比例) 和許多其他投 資工具,這些都符合毛里求斯的稅務資質,可從毛里求斯簽署的雙重稅收協 定 DTA 中受益。 盡管全球營業執照 GBL 的稅率為 15%,但稅法允許基本的 外國稅收抵免已支付的外國稅款金額,最高可達毛里求斯應納稅額。 在沒有 證明的情況下, 國外繳納的稅款被推定為毛里求斯稅款的 80% 。 因此, 有效 稅率將在 0% 到 3% 之間。 基金和集體投資計劃以及從事金融業務活動的公 司也可獲得 全球營業執照 GBL 許可。 另一方面, 被授權公司可開展貿易類 項目,包括貨品計價和當地產。

習近平主席表示中國將盡最大努力與非洲保持高度貿易往來與政治盟友地位,非洲擁有 15 億消費者的潛力,在聯合國大會上有54個發言權。 非洲大陸不僅擁有的巨大自然資源儲備,并且在基礎設施,藍色經濟和農業方面也具備力。

毛里求斯擬將自己定位為非洲與中國之間的紐帶。面對遼闊的大陸,那些群島類型的主權國家有著相同的命運。(新加坡、紐約、摩納哥、馬耳他 等…… )

毛里求斯將是投資非洲的最佳選擇。

環球云鏈·世界商人網主編王曉玲在毛里求斯駐華大使館(資料)

毛里求斯能夠提供所有上述優惠政策以開拓市場, 旨在充分借助中毛自由貿 易協定建立中非企業,我們希望與業內有意向的伙伴展開合作 .

使館將為各位提供全方位的服務,使您的企業能夠快速了解有關市場的當地 專業知識。 使館將促進并授權您的企業與政府高層、政要以及企業和商業領 袖進行溝通。 我的辦公室還將協助為您提供有關法律法規領域中合適的顧問, 并讓您了解該國的商業環境和當地文化習俗。 使館將與所有有意通過毛里求 斯投資非洲的利益相關方建立定期溝通和跟進機制。

此次網絡研討會結束后,我期待與毛里求斯部長和瑞致達作為合作伙伴舉行 一次匯報會,我們將共同制定行動計劃,以進一步協助作為投資者的您,并 提供最佳解決方案。 如果您在本次網絡研討會后需要更多信息或澄清,請隨 時與我預約。 就此,感謝各位嘉賓, 百忙之中抽出時間參加此次會議,并祝 各位一切順利。

---------------------------------------------------------------------------------------------------

Speech of the Mauritius Ambassador to China

Distinguished Colleagues,

Dear Guests and Friends,

Good Morning to South Africa and Mauritius and Good afternoon to all the people from Asia.

I extend a warm welcome to colleagues and guests attending this Webinar from China and elsewhere. I am thankful to Vistra for inviting me to this webinar.

環球云鏈·世界商人網主編王曉玲(左)與毛里求斯駐華大使王純萬閣下(中)在毛里求斯駐華大使館合影(資料)

Ladies and Gentlemen

Traditionally, Mauritius is best known as a tourist destination with its white beaches and high-class resort hotels. However, over the past decade the island has been recognised as a well-regulated international financial centre, attracting major banks, multinational corporations, fund managers, and high-net-worth individuals.

The jurisdiction appeared on the first ‘white list’ issued by the Organisation for Economic Cooperation and Development (OECD) as being committed to implementing the internationally agreed tax standard.

The development of the financial services sector in Mauritius dates from 1992, and ever since then, the island has attracted a number of international businesses investing across the globe. Mauritius is a hub for both inbound and outbound investments for many countries and including China to Africa. Increasingly the island is being recognised as a platform for investment into African countries.

The location of Mauritius gives the island a significant advantage in servicing African markets and official statistics show that a significant portion of foreign direct investment into Africa has been structured through Mauritian investment vehicles.

Mauritius is a member of several regional trade blocks, including the Common Market for Eastern and Southern Africa (COMESA) and the Southern Africa Development Community (SADC), and has signed a wide network of Double Tax Agreements (DTAs) and Investment Promotion and Protection Agreements (IPPAs).

The island has close historical, political, economic, and cultural ties with countries including China, and European nations such as France and the UK. It has a hybrid legal system based on English common law and French Napoleonic civil code.

The attraction of Mauritius today as an international financial centre goes beyond tax planning considerations. Investors choose Mauritius as a favourable holding company jurisdiction for commercial reasons, including the high quality of service, the legal and regulatory frameworks, and the excellent reputation of the jurisdiction. The island also has a track record of political, economic, and social stability

Ladies and gentlemen

I am sure that the honourable ministers will mention some important aspects,like:

§ stepping stone platform for global investment

§ common jurisdiction for pooling of investors

§ access to extensive DTA network including 10 Asia Pacific countries and 15 African countries

§ low tax jurisdiction with attractive fiscal policies

§ investor friendly jurisdiction

§ no exchange controls

§ efficient banking sector

§ confidentiality of information

§ availability of qualified multilingual professionals

The Global Business sector of Mauritius offers the ideal platform for structuring of investment into Africa. With the Various investment vehicles which Mauritius offers such as the fund, corporate structures, trust (certain percentage) and many others, are those which qualify as tax resident in Mauritius and can thus benefit from the DTAs that Mauritius has signed. Although GBL are taxed at 15%, the tax legislation allows an underlying foreign tax credit equal to the amount of the foreign taxes paid, up to the amount of tax due in Mauritius. In the absence of proof, the amount of foreign tax paid is presumed to be 80% of the Mauritius tax. Hence the effective tax rate will be between 0 and 3%. Funds and Collective Investment Schemes as well as companies engaged in financial business activities are also licensed as GBL. Authorised companies on the other hand are ideally suited for trading purposes, invoicing, or real estate holding.

Ladies and gentlemen

President Xi has asked Chinese to do the most to keep Africa as the best Trading and political allies which has a potential of 1.5 billions consumers and 54 Voices in the UN assembly. Besides the huge reserve of natural resources that the African continent possess are amongst the essential’s elements for infrastructures, blue economy and agriculture.

Mauritius could possibly position itself as the Hub between Africa-China. the identical destiny of those Sovereign State Islands before a huge Continent. (Singapore, New York, Monaco, Malta, and others...)

Mauritius will be the best place to invest in Africa.

We should be able to tap the markets for all the above listed benefits which Mauritius offers, our aim is to have Mauritius help to establish Chinese/African businesses by making the most of FTA China - Mauritius, we hope to do it together with the right private practioners in the industry.

The Embassy offers an all inclusive and integrated service to all and will enable your enterprises to gain quick access to local expert knowledge about the market. The Embassy will facilitate and empower your enterprises to accede to high level government contacts, official dignitaries and corporate & business leaders. My office will also assist to channel to right advisors for you around legislation and regulations as well as get you to know the business environment and local culture, customs of the country. The Embassy will establish a regular communication and follow up mechanism with all stakeholders intent on investing in Africa via Mauritius.

Ladies and Gentlemen,

After this webinar, I look forward to holding a debriefing session with the Honourable Ministers of Mauritius and Vistra as a partner, we shall work together on plan of actions to further assist you as investors and provide the best solutions to you. Please feel free to seek an appointment with me if you need further information or clarifications following this webinar. I therefore, thank everyone who has made time to attend and wish you all the best.